5 ROLES LIFE INSURANCE CAN PLAY IN YOUR RETIREMENT PLAN

More than a benefit for loved ones you leave behind, life insurance can play a key role in your retirement plan. Life insurance can supplement other retirement strategies in various ways, including acting as a source of emergency cash, loan funds, or simply as the confidence that comes with knowing you’ve covered all the bases.

How you use life insurance to assist your retirement goals depends on which type of policy you chose. Term life insurance will cover you for a predetermined amount of time, but you may have the option to renew that policy after it expires. Whole life insurance keeps you covered for the remainder of your life.

Below we’re discussing five ways in which you can utilize your current life insurance policy as a tool in retirement.

Role #1: Cash-Value Withdrawal

Permanent life insurance plans (like whole life) may include an interest-earning feature. You can withdraw cash from a whole-life plan or take out a loan. This provides retirees options for protecting assets while taking care of expenses without depleting another retirement fund.

If you’re withdrawing up to the amount you’ve already paid in premiums (known as the policy basis), the withdrawal may be tax-free. Any income you withdraw beyond the policy basis, however, is considered a gain and would be subject to income tax.

As you consider this option, remember that the amount you remove will reduce your death benefit. It’s typically best to use this option only to take care of emergencies.

Role #2: Taking a Loan

You can borrow against the value of a whole life plan if you’re in need of funds immediately. If you choose to go this route, you’re borrowing the money you’ve already paid into the plan.

Taking out a loan will incur interest, and it will be added to the balance owed. The loan – plus interest – is repaid from the death benefit, meaning you’ll be leaving your loved ones with less. Perhaps a worse outcome of not repaying the loan in a reasonable time would be the loan balance exceeding the cash value, like an underwater mortgage. If this is the case, the policy will lapse.

Role #3: Life Insurance Policy Riders and Retirement Plans

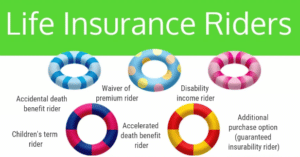

You can add a rider to your whole or term life insurance plan. A rider is a supplemental benefit you pay extra for and is commonly referred to as accelerated benefits. Riders may cover an unexpected expense or a specific type of death event. For example, a catastrophic illness rider will allow you to use the cash value to handle certain kinds of emergency medical expenses. It’s different than a liquidating cash value and will reduce the death benefit. With regards to a retirement plan, riders such as a catastrophic illness rider can expire after age 65, depending on the insurer.1 Riders may be more beneficial for early retirees.

Role #4: Tax Benefits in Retirement

Life insurance policies can shelter part of your retirement plan from being taxed by the federal government. If you have a cash-value plan, the IRS will not tax the growth yearly but will tax the income when you cash out.2 The taxable amount will be the difference between the total premiums paid and your cash-out amount.

The withdrawals from and loans against your policy will be tax-free. This includes the funds from accelerated benefits. It’s important to note that if you have a life insurance plan paid by your employer, anything above $50,000 is considered taxable income.3

Role #5: Safety Amidst an Economic Downturn

A whole life plan with cash value won’t be influenced by stock market fluctuations. If you have a diverse portfolio, some portion of your retirement savings may lose value during an economic downturn. When this is the case, you may need to rely on your cash-value assets while stocks and other assets take time to recover their value.

Any life insurance plan can become a part of your retirement plan. However, to see a substantial benefit, it can take several years. As with any retirement plan, starting early with a life insurance policy can yield the greatest benefits to you and your family. Discuss what kind of life insurance policy can be most beneficial to you with an independent, fiduciary financial advisor. Incorporating insurance products into a holistic wealth management strategy can protect your assets and provide confidence in the transfer of your wealth to the next generation.

Award-winning CPAs and CFPs, the financial advisors at Outlook Wealth Advisors, offer a unique, holistic perspective most other firms simply cannot offer. They have assisted retirees and pre-retirees manage wealth and prepare tax-friendly retirement plans over 25 years. Email us at info@outlookwealth.com or call 281-872-1515 to get started.

- https://www.investopedia.com/terms/d/dreadeddiseaserider.asp

- https://www.irs.gov/pub/irs-drop/rr-09-13.pdf

- https://www.irs.gov/government-entities/federal-state-local-governments/group-term-life-insurance